James Rickards has given few days ago a very interesting interview to Mineweb Radio in South Africa.

I consider this as the best summarized description of monetary war (so called 'currency war'), albeit a very short one.

I only disagree with a point : Rickards described 3 phases in the monetary war : 1921-1936 ; 1967-1987 ; 2010-now.

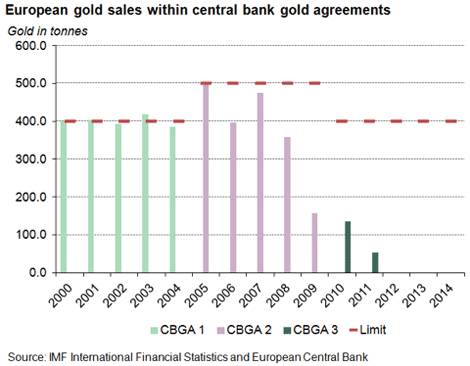

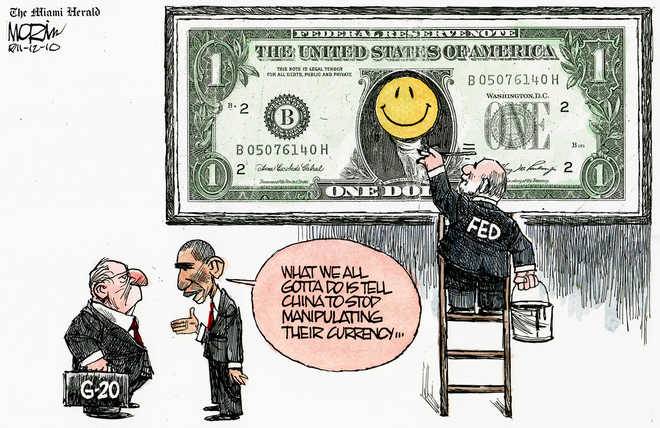

In fact, the current crisis is rampant since 1967. One major event has temporarily covered up the monetary crisis: the strategic partnership between US and China, which has sustained the international role of the US dollar, but without reforming any fundamental weaknesses. The CBGA first gold agreement in 1999 was a significant sign that the monetary crisis, like a dormant virus, was still there.

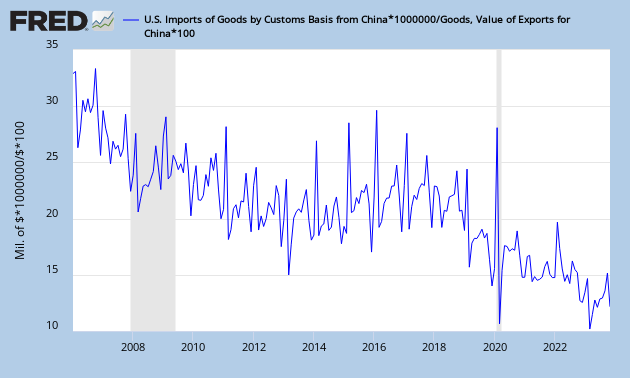

The US/China monetary partnership has been broken since 2009/10, and this has unveiled a new wave of the monetary crisis.

Here are a few pictures from my Research Pages to illustrate the major trends:

Here are a few pictures from my Research Pages to illustrate the major trends:

Data serie since 1985

U.S. : Velocity of M2 money stock (lhs; using GDP/M2);

Velocity using M2 / StLouis Fed non-adjusted monetary base (rhs);

Data series since 1959